Like Having a Financial

Expert In Your Pocket

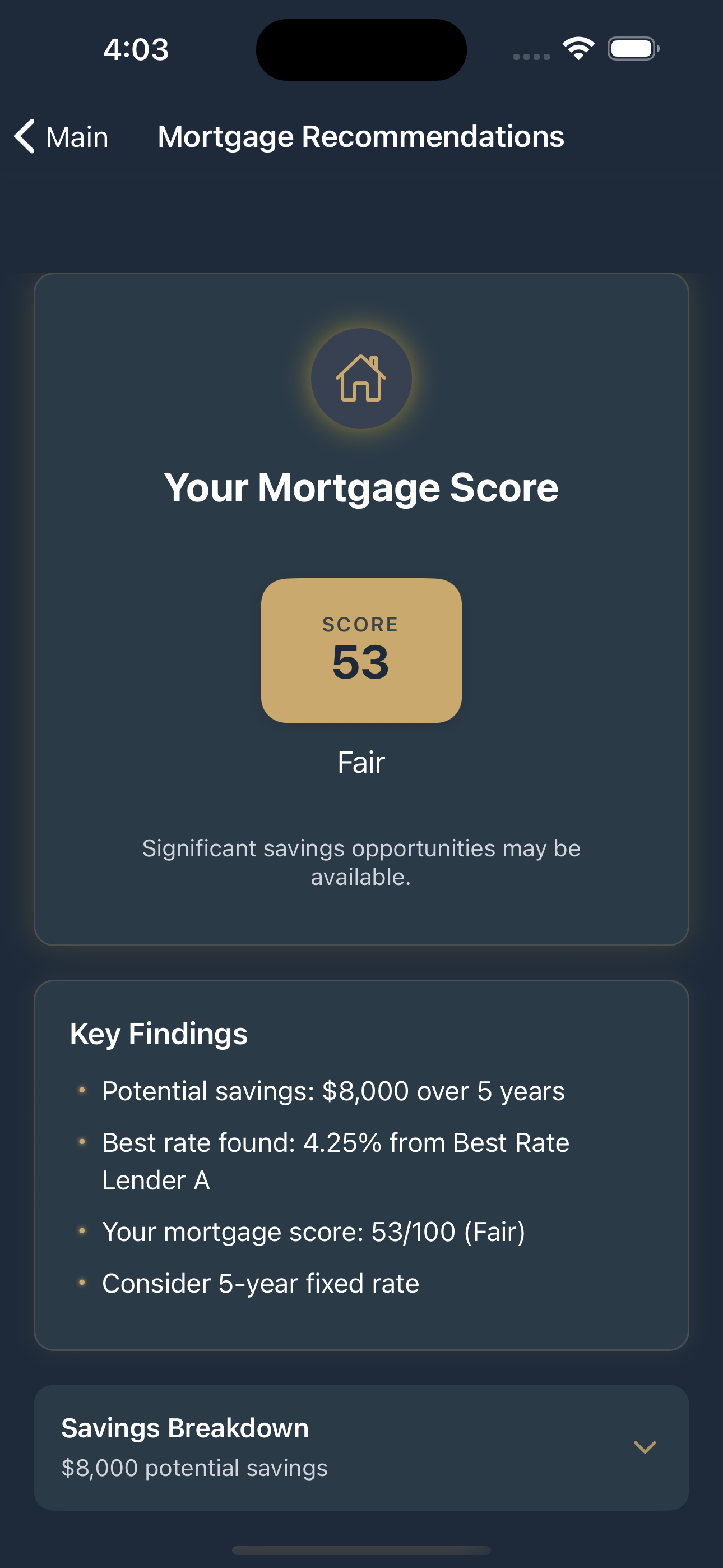

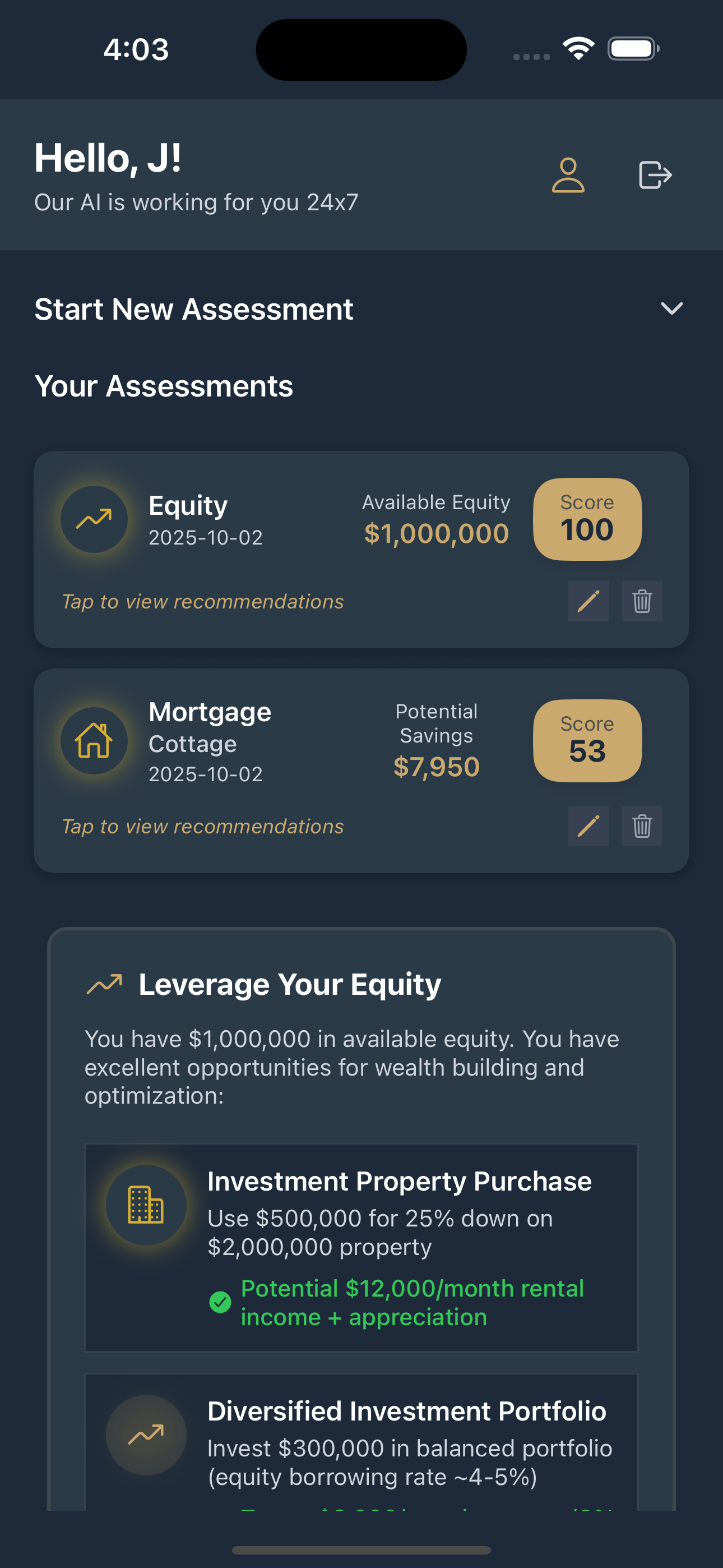

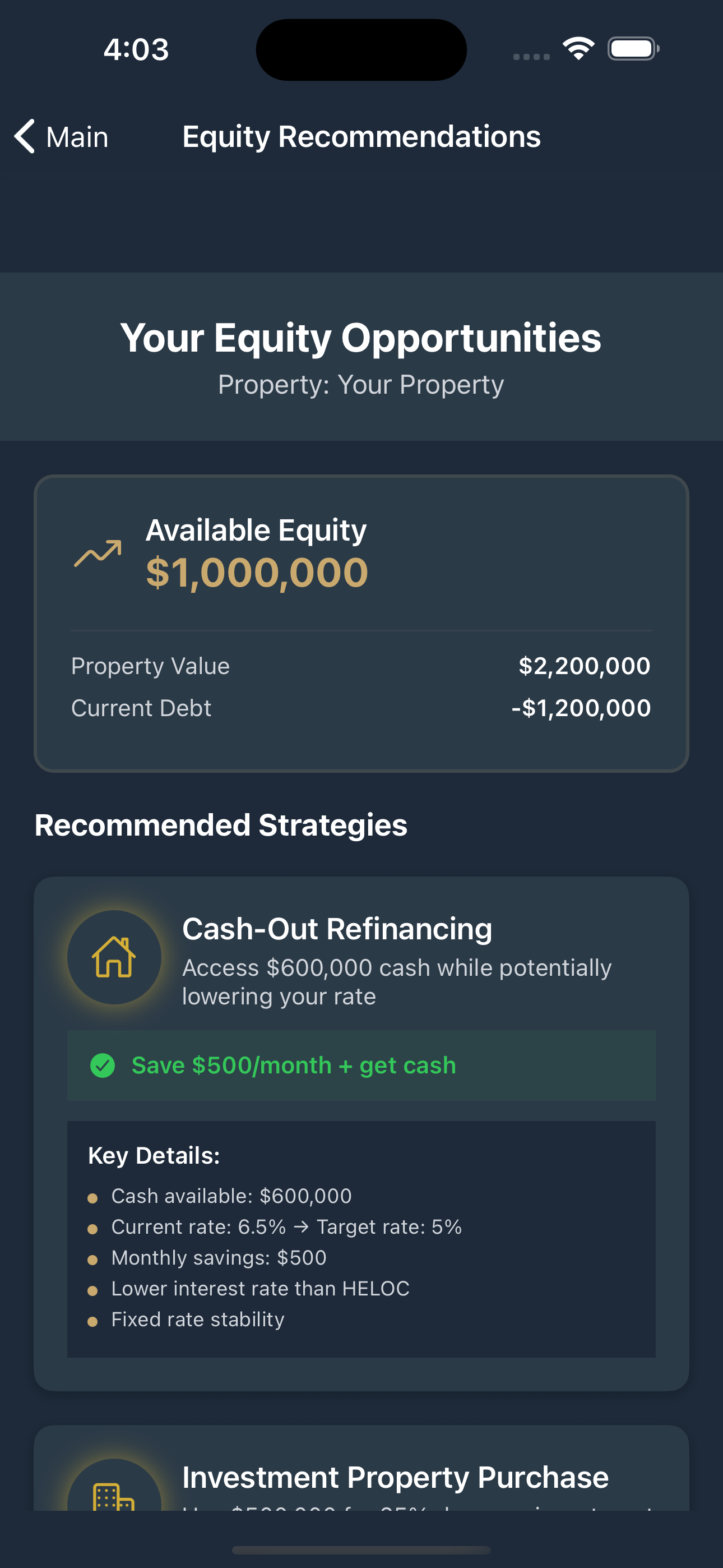

Imagine an AI assistant so powerful it's like having a personal financial expert—constantly

evaluating every mortgage option, tirelessly seeking ways to save you money, every second of every day.

No need to imagine. Experience it today.

Take back control.